COVID, Inflation, Supply & Demand and How to Get On With Business

February 17, 2022 by Morten B. Reitoft

There is no question that many printing companies are challenged by the extremely limited paper supply and the exorbitant price increases. The increased prices influence many businesses, of course, but let's try to understand why and how to overcome the obstacles.

COVID changed the supply and demand of paper

In general, prices are influenced by supply and demand. When COVID hit, the need for paper on some products decreased. Paper mills adjusted their production accordingly - or at least that is what we are led to believe!

A few of the leading players in the market - Sappi, UPM and Stora Enso, grow their overall business. These giant companies have operating income from other sources than paper and typically divide their business into packaging, forestry, wood-products, bio-materials, etc. When paper demand is decreasing - and it is - it's only natural that the manufacturers change focus and serve more profitable products - precisely like we in the graphics arts industry should do!

When demand falls and when looking at the over-capacity of paper, it’s only natural for prices to fall. Lower prices mean lower margins - so maybe the pandemic was the best thing that could happen to the paper industry. Everybody was in the same boat and the advantage for a paper mill to cut costs and adapt to the new normal could be essential for its survival.

Some paper mills also took the opportunity to change production to cardboard and other product types, now leaving many printing companies with supply constrictions and higher prices.

Trees, however, are NOT influenced by the pandemic and grow despite it, so the supply of pulp may be affected shortly, but with increased prices on paper, the supply should, if we can trust market mechanisms, even out over time.

Competitive pricing

Before the pandemic, the paper industry was in tough competition and supply was way higher than demand. When demand decreased, it became a golden moment for the paper industry to adjust supply, increase prices and profit!

And - friends - with more competition, I am convinced that supply will revert to a more normal level, but I am also convinced that prices will NOT be as low as before. Therefore, we need to adjust our prices accordingly and be aware that it changes the competitive situation in the market.

Effects of inflation

If we look at the value-chain of a printed product, the paper only represents a small percentage of the total price - at least if we consider all processes. However, we (as printers) rarely do! We often look at our budgeting and see that paper takes a bigger and bigger share of the print price. However, if you think about the process of developing a project from start to finish - idea, text, photo, design, print, packaging, postage, etc., paper, of course, only represents a fraction overall.

With the labor shortage in almost all industries, wages have increased just like prices on products, interest rates, services, energy, transportation, etc. As a result, inflation has increased and the negative effects are compounding.

COVID has influenced all these developments. With the governments supporting businesses, the economy has been on artificial life-support during the pandemic. As the pandemic comes to an end (knock-on-wood), the demand is dramatically increasing in almost every market, pushing those aforementioned consequences even further!

Many households in the Western world have not spent much money during the pandemic. Spending money on holidays, traveling, restaurants, entertainment, etc., has been canceled for two years and many people have bolstered saving accounts (In the US, the average savings have increased from 14% to almost 20% during the pandemic). I was a bit surprised when I looked at the OECD CCI (Consumer Confidence Index) - which is defined by the following:

"This consumer confidence indicator provides an indication of future developments of households' consumption and saving, based upon answers regarding their expected financial situation, their sentiment about the general economic situation, unemployment and capability of savings."

Of course, consumers experience inflation when gasoline, heating, food, etc., become more expensive - and I must admit when looking at my family's finances, the increased prices on heating, i.e., are not very comforting.

What can you do to survive?

Understanding the metrics is important. One of the first and most important things to remember is that ALL printing companies are in the same situation. So raising your prices because of the increased cost on raw-material will NOT in itself throw a customer to your competitor. All PSPs are in the same situation.

Understanding the metrics is important. One of the first and most important things to remember is that ALL printing companies are in the same situation. So raising your prices because of the increased cost on raw-material will NOT in itself throw a customer to your competitor. All PSPs are in the same situation.

You have to talk to your clients about this and yes, some will consider not to print, some to limit their print and others will pass on the prices to their customers (pushing inflation further), but as I believe paper prices will NOT come back to the level from the past, you better get the conversation started!

When I was in the airport a few weeks ago, I was looking at a hardcover book from one of my favorite authors and the SRP on this book was about €40. A pretty steep price and first I, of course, take off the 25% VAT and it gets to €32 - and yes, the retailer, the distributor, the publisher and the author all need to make money, but the paper percentage of this one book is a fraction. I know prices vary and vary from product type to product type. Still, this example is good since it indicates that paper IS a fraction of any product and that it is possible to argue with your customers about this!

You have to consider new equipment, automation and new business models when prices are aligned. If you look at how consumers buy products, more and more is happening online, that changes everything. Alone in the US, offline vs. online change has changed from 2018 to 2020 from 90.1% to 85.5% - and I am confident that it will continue!

Another thing is product- and business-model development. With unique products, you can more easily protect your margins and though you, of course, need to produce a diverse range of products, your sales and earnings can be split on multiple products - because it's fun, but also it minimizes risk.

Again, the new market situation is an opportunity on the business model side. More and more printing companies offer their services via APIs and I believe in the future that new business models (AND planning/estimations models) are required to survive. For the PSPs not able to develop, there might be a small loophole - because if the majority of PSPs can convert and define their businesses - maybe there is room for a few conventional commercial printing companies? I wouldn't bet on it, but who knows!

So, in short:

- Changes in the supply chain is an opportunity

- Understand the underlying metrics

- Develop products, services and business models

- Market your products and services to segments you can profit from

- Integrate - business and technology

- Understand and implement the Digital Mindset

- Work with suppliers who support your business objective

And well - survival of the fittest will once more prove to be a fact and the industry WILL come out stronger. I am 100% confident about this!

Want more articles like these delivered straight to your inbox? Register for a ColorBase.com account to subscribe to our newsletter!

Read more articles

Re-board®: Making Sustainable Event and Exhibition Constructions

Source: https://nordwerk.co/ For those seeking environmentally friendly alternatives to conventional materials like MDF/plywood, foams, and plastics in event and…

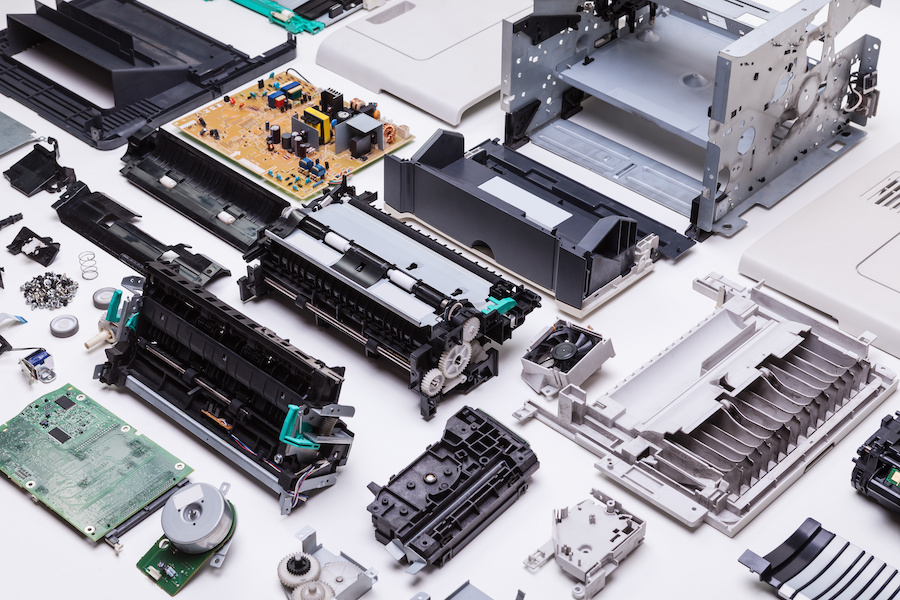

Why Printer Maintenance is Important in Color Management

It was mid-summer in the Midwest. My business partner and I were driving from our home state to an…

ColorBase, Under the Hood: The Data Model Upgrade Enabling a Smarter Printing Industry

Quiet Transformation Our industry’s most advanced database of material, printer, RIP and ICC profile data is undergoing a quiet…